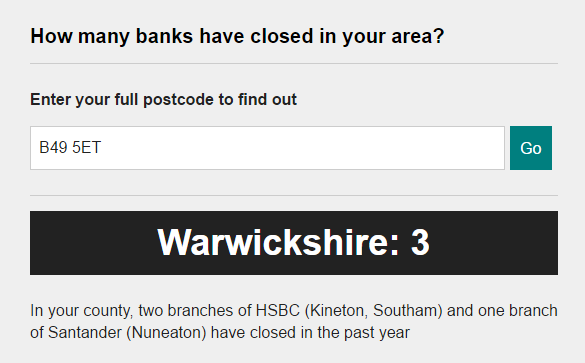

Interesting stats on the BBC this morning about bank closures. In true Beeb style, you can add your Postcode and see how many local branches you have lost recently.

UK banks close more than 600 branches over the last year - BBC

But in this online world is it really a surprise? If High Street chains can't cope, then why would a bank be different?

From a business point of view, we have no need to have any physical interaction with a branch. It is all done online or in rare cases over the phone if there is an issue. We don't have many cheques, but our bank has a business address that we send those to and they are paid in.

So other than opening an account, when do you need to visit a branch? If you have serious business to discuss, such as refinancing your £1 million overdraft, I'm sure they will pop out and see you.

Retailers need regular visits to bank daily takings, then after that, the argument then normally goes to the elderly or vulnerable who need face to face banking, or remote parts of the UK that still has a decrepit infrastructure and poor broadband. So some kind of physical banking is required.

The beeb article points to the 11,500 Post Office Branches which already offers basic banking services. Surely this is the answer, with maybe a pot of cash contributed to by all the big banks to subsidise rural or unprofitable Post Office locations, but keeps face to face banking for those that need it.

Banks save a fortune by not having to maintain a huge branch portfolio, and the Post Office wins by getting branches subsidised. Plus they can pass savings onto us mere mortals and give us more than 0.5% interest!

What does anyone think? A realistic solution to a problem that will inevitably get worse?