It really has been a terrible 12 months for the Co-op as they lurch from one crisis to the next.

I love looking at business models, and the Co-op one intrigues me. It's a mutual, so owned by it's members, as opposed to John Lewis which is owned by it's workers.

But until it hit the news I didn't realise how big the Co-op is. It has a staggering 90,000 employees and fingers in just about every pie going.

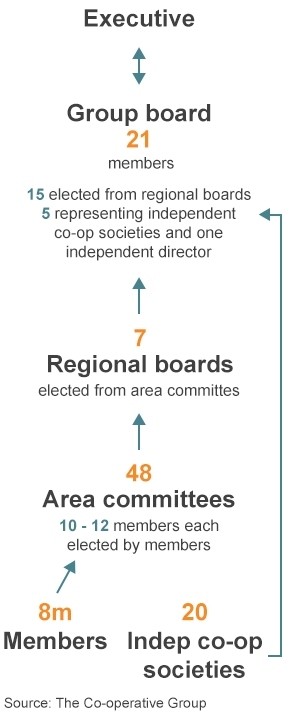

But is the mutual model flawed? It seems to be a really complex structure of boards and committees, and reminds me more of a Local Authority than a company.

There's a great article on the Beeb that explains in detail how the Co-op is run, but the graphic sums up the level of comlexity.

We are always hearing about the success of John Lewis, is it just a simple fact that the workforce are the owners, so everyone has a vested interest. Plus when things are going good, everyone from boardroom to till operators gets a bonus.

Lord Myners has been appointed to review the company structure and advise on reforms, so it will be interesting how a group of this size is going to be turned round!

I don't know how sustainable a £2.5bn loss is, so what's the verdict? If you were the top boss what would you do?

Break the business up into manageable independent chunks? Try and move to a John Lewis model? Or just clean out the loss making side of the business (the bank) and concentrate on the areas that are working?